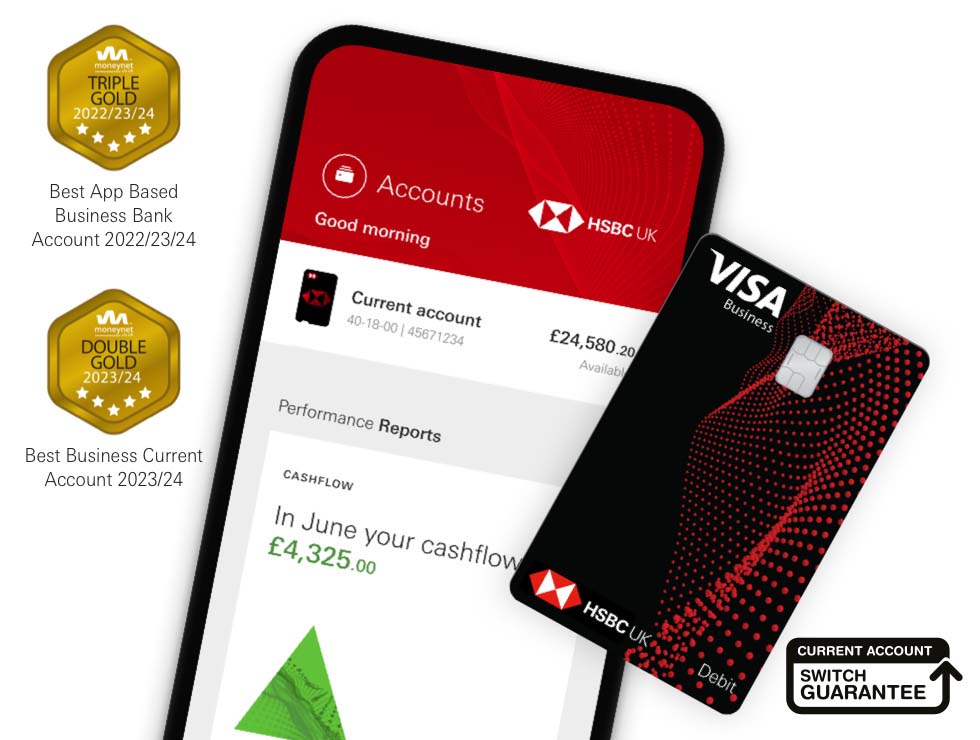

*1 There is no monthly current account maintenance fee for 12 months from account opening date. The monthly current account maintenance fee after the fee free period is £6.50 per month. Fees subject to change, customers will be notified in advance. Other fees and charges apply, see pricelist for details. Subject to eligibility, credit check and terms and conditions.

*2 If you know your funding requirements are or will be more than £10k, this may not be the right solution for you at this time. Please

find out more about the HSBC Kinetic lending products before applying.

*3 Free banking means no account maintenance fee and free standard transactions on your primary account, any additional or secondary accounts will be charged in line with the Small Business Banking Account.