You'll find both your IBAN and BIC on your paper bank statement.

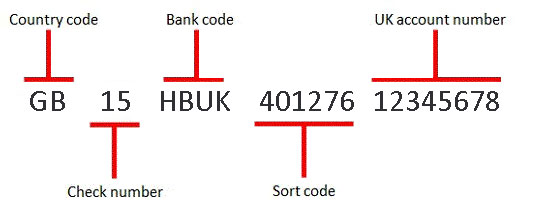

Your IBAN will look like this: GB15HBUK40127612345678 please note the bank code and sort code will vary according to your account. The below is provided as an example. The IBAN will vary based on your account. Please check the actual IBAN which is specific to your account, this can be found on your statement.

What do the letters and numbers mean?

- Country code identifies the country in which the IBAN was issued and where the IBAN account is held

- Check number enables a banking institution to complete an integrity check of the IBAN. It will vary from one IBAN to another

- Bank code identifies the IBAN account holder's bank

- Sort code and account number identify the account into which funds should be transferred. You will see from your statement that these are the same as your UK bank account details

The structure is consistent but the actual length, which can be up to 34 characters, depends on the national standards of the country in which it is issued.

Your BIC is the code that helps overseas banks identify which bank to send money to, below is an example of how a BIC is constructed. The bank code will vary based on your account.

Please check the actual BIC which is specific to your account, this can be found on your latest statement.