HSBC UK Corporate Tracker

Article

There are signs that demand is stabilising, but subdued consumer confidence points to a fragile out...

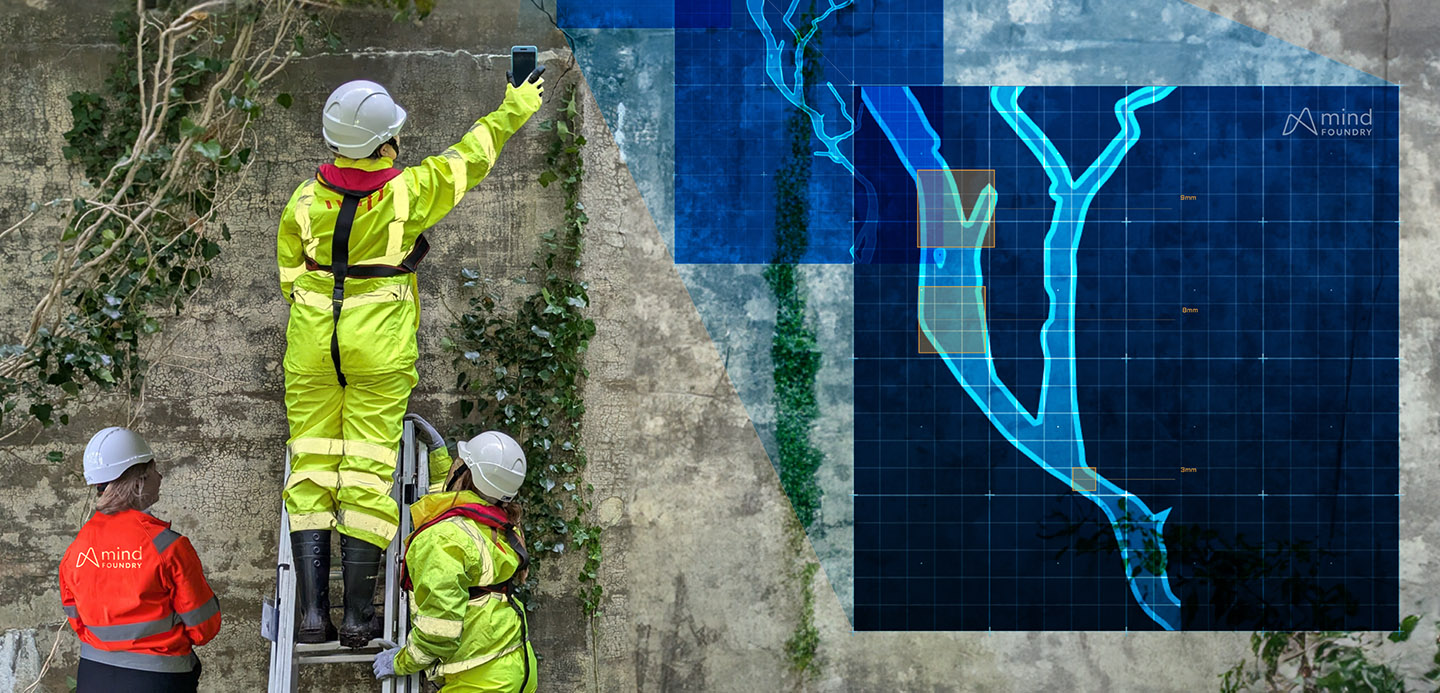

Every sector is unique, which is why we have sector specific specialists who use their in-depth knowledge and expertise to provide tailored support and insight for your business, at every stage of its growth.